Press Release

|April 25,2025Private Home Prices And Hdb Resale Prices Rose At A Slower Pace In Q1 2025; Us Tariffs And Us-china Trade Tensions May Cloud Sentiment

Share this article:

25 April 2025, Singapore - Prices of private residential properties and HDB resale flats continued to rise in Q1 2025 from Q4 2024 albeit at a slower pace, according to statistics from the Urban Redevelopment Authority (URA) and the Housing and Development Board (HDB). Demand for private homes and resale HDB flats was relatively stable in Q1 2025, but there are downside risks ahead as tariffs uncertainty heightens caution.

Q1 2025 URA Private Residential Property Index

Private home prices inched up by 0.8% QOQ in Q1 2025, moderating from the 2.3% QOQ growth in Q4 2024 (see Table 1). The final print is higher than the flash estimates of a 0.6% QOQ increase published earlier this month. On a year-on-year basis, the URA PPI was up by 3.3% from Q1 2024. The pace of price growth eased across all segments, with the exception of landed homes, where prices rose by 0.4% QOQ, overturning the 0.1% QOQ decline in the previous quarter.

Table 1: URA Private Property Price Index (PPI)

Price Indices | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q4 2024 | Q1 2025 |

(QOQ % Change) | (YOY % Change) | (QOQ % Change) | ||||

Overall PPI | 1.4 | 0.9 | -0.7 | 2.3 | 3.9 | 0.8 |

Landed | 2.6 | 1.9 | -3.4 | -0.1 | 0.9 | 0.4 |

Non-Landed | 1.0 | 0.6 | 0.1 | 3.0 | 4.7 | 1.0 |

CCR | 3.4 | -0.3 | -1.1 | 2.6 | 4.5 | 0.8 |

RCR | 0.3 | 1.6 | 0.8 | 3.0 | 5.8 | 1.7 |

OCR | 0.2 | 0.2 | 0.0 | 3.3 | 3.7 | 0.3 |

Source: PropNex Research, URA

For non-landed homes, prices grew by 1.0% QOQ in Q1 2025 after recording a 3.0% QOQ growth in Q4 2024. All three sub-markets witnessed slower price increase in Q1 2025, led by the Rest of Central Region (RCR) with a price growth of 1.7% QOQ, followed by the Core Central Region (CCR) and the Outside Central Region (OCR) where prices rose by 0.8% QOQ and 0.3% QOQ, respectively.

In Q1 2025, developers sold a total of 3,375 new units (ex. EC) - already more than half of the 6,469 units shifted in the entire 2024. The new private home sales tally in Q1 2025 is slightly down by 1.3% from 3,420 units transacted in the previous quarter. On a YOY basis, new home sales more than doubled from 1,164 units in Q1 2024.

The OCR drove developers' sales in Q1 2025, with 2,238 units (ex. EC) sold, marking the highest quarterly sales in the sub-market in more than a decade, since 2,760 units were transacted in Q2 2013. In Q1 2025, OCR new home sales jumped by 57% QOQ from 1,424 units moved in Q4 2024. In particular, Parktown Residence, Lentor Central Residences, and ELTA topped OCR sales in Q1 2025, shifting a combined 1,836 new units (or 82% of the OCR total) during the quarter, based on caveats lodged.

According to the URA, there were 18,125 unsold uncompleted private homes (ex. EC) in the pipeline as at the end of Q1 2025 - down by 6.6% from 19,405 units in the previous quarter. The unsold stock in Q1 2025 is the lowest in five quarter, since Q4 2023 where there were 16,929 unsold uncompleted units (ex. EC). Developers launched 3,139 new units (ex. EC) for sale in Q1 2025, a touch lower than the 3,425 units put on the market in Q4 2024.

Over in the resale private housing market, there were 3,565 units resold in Q1 2025 - down by 3.7% from the 3,702 units sold in the previous quarter. Resale transactions made up 49.1% of the overall private home sales (including new sales and sub-sales) in Q1 2025; this is the smallest proportion in 19 quarters, since Q2 2020 where the corresponding proportion of resale against total sales was 35%. We note that the lower resale proportion in recent quarters came on the back of a slew of new launches that have boosted developers' sales.

In the private residential leasing market, rentals inched up by 0.4% QOQ in Q1 2025, after staying unchanged in the previous quarter. On a YOY basis, the URA private residential properties rental index in Q1 2025 was also up by 0.4% from Q1 2024. There were 20,409 private home leasing transactions in Q1 2025, rising by 3.2% from the 19,782 rental contracts done in Q4 2024. Meanwhile, the median monthly rental in Q1 2025 ticked up marginally to $4.99 psf from $4.90 psf in the previous quarter, as per URA Realis data.

Mr Ismail Gafoor, CEO of PropNex Realty said:

"Helped by the strong buyer sentiment in Q1 2025, the number of new private homes sold crossed 3,300 units (ex. EC), marking back-to-back quarters where sales pushed past the 3,000-unit level. The last time developers' sales exceeded 3,000 units for two straight quarters was in Q3 and Q4 2021. In the executive condo (EC) segment, there was overwhelming interest, with the 760-unit Aurelle of Tampines selling out within a month since it was launched in March. The increase in the supply of EC sites under the government land sales programme will cater to the healthy demand for such homes and help to keep EC prices stable.

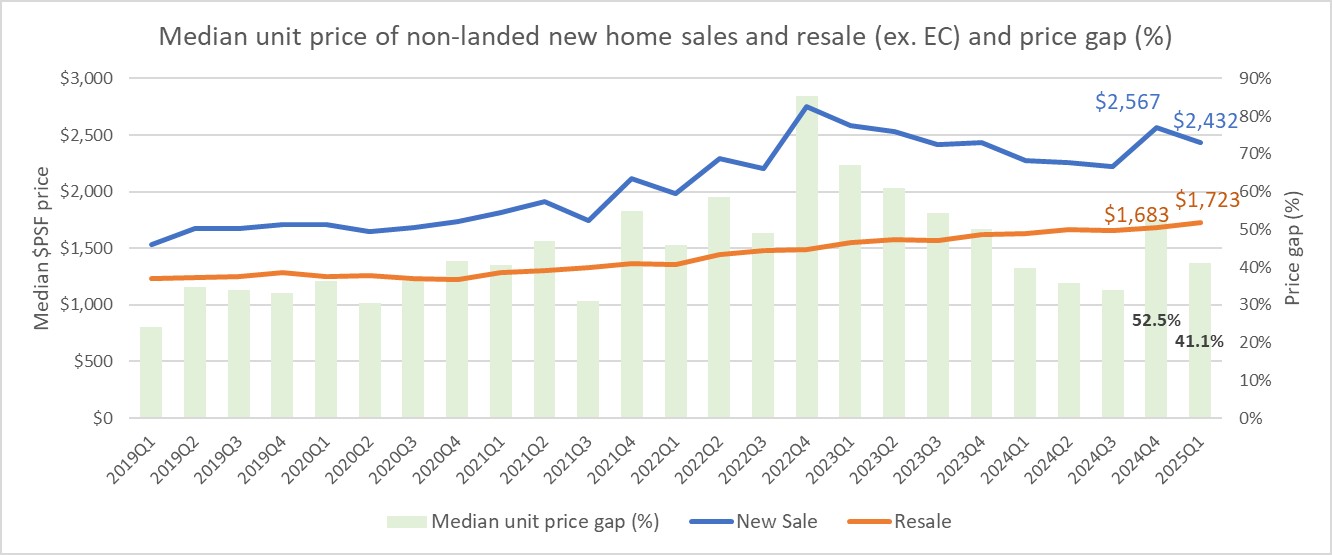

Meanwhile, the private resale market saw slightly softer QOQ sales in Q1 2025, perhaps due to some buyers being drawn to the new launches. Based on caveats lodged, we note that the median unit price gap between non-landed new private homes (ex. EC) and resale properties narrowed to 41.1% in Q1 2025, from 52.5% in Q4 2024 (see Chart 1). This is mainly due to more OCR homes being transacted during the quarter from new launches. With mostly CCR and RCR projects anticipated to be launched in the coming months, we expect that the median $PSF price gap between new sale and resale private homes may widen slightly.

Chart 1: Median unit price of non-landed new private home sales and private resale (ex. EC) and price gap (%)

Source: PropNex Research, URA Realis

Table 2: Median unit price of non-landed new private home sales (ex. EC) by region and price gap between regions (%)

Median $PSF price of non-landed new home sales | Price gap between regions (%) | |||||

CCR | RCR | OCR | CCR vs RCR | CCR vs OCR | RCR vs OCR | |

2024Q1 | $3,190 | $2,563 | $2,222 | 24.5% | 43.6% | 15.3% |

2024Q2 | $3,294 | $2,613 | $2,108 | 26.1% | 56.3% | 24.0% |

2024Q3 | $3,211 | $2,592 | $2,110 | 23.9% | 52.2% | 22.8% |

2024Q4 | $2,806 | $2,613 | $2,435 | 7.4% | 15.2% | 7.3% |

2025Q1 | $2,736 | $2,708 | $2,352 | 1.0% | 16.3% | 15.1% |

Source: PropNex Research, URA Realis

Comparing the median $PSF price of new non-landed home sales (ex. EC) across sub-markets, the price gap between CCR and RCR narrowed to 1.0% (see Table 2) in Q1 2025 - the slimmest since Q1 2013 (price gap was -7.3% then). Meanwhile, the median unit price gap between CCR and the OCR remained relatively tight at 16.3% in Q1 2025 compared with 15.2% in the previous quarter. In a two-speed market where prices in the RCR and OCR have been firm and with the price gap having narrowed, we expect that there are potential buying opportunities in the CCR.

In the private home leasing market, we continue to see stabilsation. In the near-term, with leases already locked in previously, we expect the rental market to be fairly stable. However, the tariffs-related impact bears watching, as home leasing demand could be affected should businesses refrain from expanding their operations, increase headcount or if they cut accommodation benefits for expatriate staff. In Q1 2025, 1,988 private homes (ex. EC) were completed, and another 3,932 units are expected to come on in the rest of the year - bringing the total estimated completion in 2025 to 5,920 units, lower than the 8,460 units completed in 2024. The lower supply of new completions in 2025 may help to support rentals.

Overall, the private residential property market posted a commendable performance in Q1 2025 and we expect that it could remain fairly resilient this year, although the tariffs uncertainty and rising US-China trade tensions may potentially cloud market sentiment. Having said that, we note that the Singapore residential property market has a good track record of weathering various crises over the decades, emerging stronger following the Asian Financial Crisis, SARS, Global Financial Crisis, and the Covid-19 pandemic. We believe Singapore's sound economic fundamentals, stable political landscape, transparent legal system, and strong infrastructure will continue to reinforce the country's safe-haven appeal, and will be supportive of the property market in turbulent times.

PropNex projects that new private home sales could hover at around 8,000 to 9,000 units (ex. EC) in 2025, while the resale segment may see 14,000 to 15,000 transactions. Meanwhile, the overall private home prices may climb by 3% to 4% this year, in view of more city centre and city fringe launches lined up. Developers are also likely to hold prices relatively steady given the high-cost environment and firm land prices that have been committed to."

Q1 2025 HDB Resale Price Index

Data released by the Housing and Development Board (HDB) showed that resale flat prices inched up by 1.6% QOQ in Q1 2025, slowing from the 2.6% QOQ increase posted in Q4 2024 (see Table 3). It represents the slowest quarterly increase in five quarters, and the final print is slightly up from the flash estimates of a 1.5% increase published on 1 April 2025.

Table 3: HDB Resale Price Index

| Quarter | QOQ % change | YOY % change |

| Q1 2022 | 2.4% | 12.2% |

| Q2 2022 | 2.8% | 12.0% |

| Q3 2022 | 2.6% | 11.6% |

| Q4 2022 | 2.3% | 10.4% |

| Q1 2023 | 1.0% | 8.8% |

| Q2 2023 | 1.5% | 7.5% |

| Q3 2023 | 1.3% | 6.2% |

| Q4 2023 | 1.1% | 4.9% |

| Q1 2024 | 1.8% | 5.8% |

| Q2 2024 | 2.3% | 6.6% |

| Q3 2024 | 2.7% | 8.1% |

| Q4 2024 | 2.6% | 9.7% |

| Q1 2025 | 1.6% | 9.4% |

Source: PropNex Research, HDB

There were 6,590 HDB flats that were resold in Q1 2025, up by 2.6% from the 6,424 resale flats transacted in the previous quarter. On a YOY basis, the HDB resale volume was 6.8% lower than the 7,068 units sold in Q1 2024.

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty, said:

"The HDB resale price index grew for the 20th consecutive quarter in Q1 2025, booking a cumulative gain of more than 52% since Q2 2020. The 1.6% QOQ increase in HDB resale prices is the slowest quarterly growth in five quarters and could contribute to a moderation in the pace of price increase in 2025.

Given that the HDB resale market caters predominantly to Singaporean households and owner-occupiers, we expect that resale flat demand could be fairly resilient, and prices may remain stable, notwithstanding the uncertainties brought about by the US tariffs. That being said, following years of strong price growth in the HDB resale segment and more cautious sentiment, prospective buyers may balk at paying ever-higher prices for a resale flat, which may potentially limit the extent of price upside. The ample upcoming supply of BTO and SBF flats will also provide more options to prospective buyers. We estimate that overall HDB resale flat prices may rise by 5% to 7% in 2025 - easing from the 9.7% growth in 2024. Meanwhile, the resale flat volume may reach 28,000 to 29,000 units this year, as per our forecast.

Table 4: Number of million-dollar resale flats sold by price range since 2017

Source: PropNex Research, Data.gov.sg (retrieved 25 April 2025)

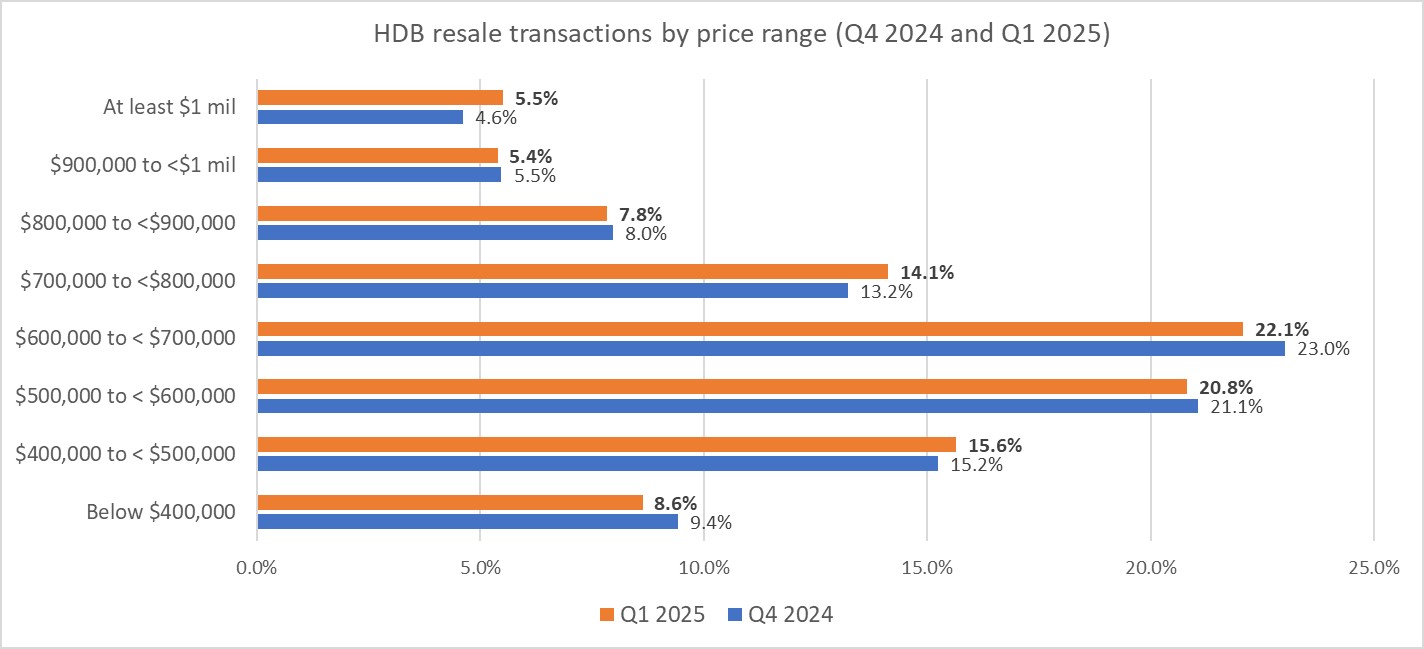

Based on HDB transaction data, the 348 units of HDB flats resold for at least $1 million dollar in Q1 2025 accounted for about 5.5% of the total resale volume in the quarter (see Table 4) - up from the 4.6% in Q4 2024 (see Chart 2). Including the 115 units of such flats sold in April (as per data retrieved on 25 April), there are at least 463 units of million-dollar flats sold in the first four months of 2025. PropNex expects the number of million-dollar resale flats sold to exceed 1,000 units again this year, as such flats - typically with very desirable attributes - are seen to offer more bang for buck versus comparable private homes in the same area, particularly among more price conscious buyers who may have a smaller housing budget.

Chart 2: Proportion of HDB resale transactions by price range

Source: PropNex Research, Data.gov.sg (retrieved 25 April 2025)

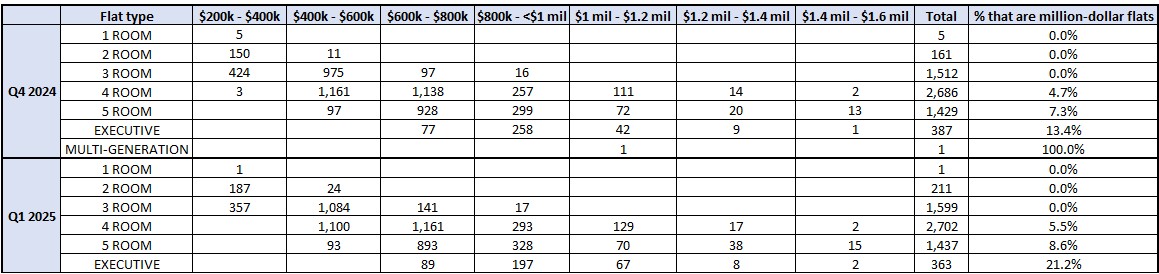

By price range and flat type, it was observed that the proportion of 4- and 5-room flats, and executive flats that fetched at least $1 million has ticked up in Q1 2025 from Q4 2024 to 5.5%, 8.6%, and 21.2%, respectively (see Table 5). Some factors that may have supported such sales include transactions of 4-room flats at projects in attractive locations that have recently exited their 5-year minimum occupation period (MOP), healthy demand for well-located 5-room resale flats, as well as the enduring appeal of larger executive flats which are no longer offered in HDB's Build-to-Order sales launches.

Table 5: Number of HDB resale flats sold by price range by flat type in Q4 2024 and Q1 2025

Source: PropNex Research, Data.gov.sg (retrieved 25 April 2025)

Meanwhile, in the HDB flat leasing market, demand rebounded in Q1 2025 with 9,662 rental approvals by the HDB - up by 12.3% from the 8,603 approvals in Q4 2024. In fact, it is the strongest quarterly figure in five quarters. We expect that the healthy rental demand including from families waiting for their new homes to be completed, as well as foreign workers and international students, coupled with the limited stock of MOP flats hitting the market could potentially help to support HDB rentals in 2025.